sustainable management

Results: financial health

Growth and reformulations

GRI G4-EC1

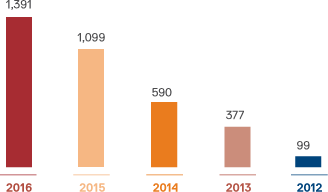

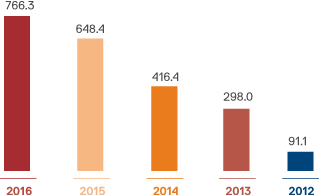

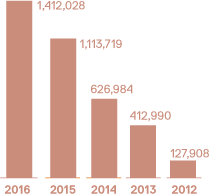

In 2016, Avibras's net operating revenue grew for the fifth year running, reaching almost ten times the 2012 figure and 27% up on 2015.

“Integrated project planning and lengthening contracts have enabled us to minimize the financial effects of seasonal variations in sales”

Cynthia Benedetto

Financial Director

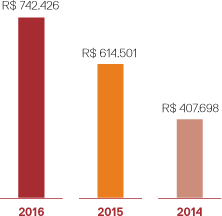

Net operating revenue (R$ million)

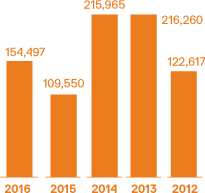

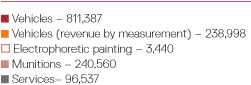

Net revenue per employee (thousands of R$)

2016 was an extremely productive year, in which the company met customers requirements, ensuring full satisfaction

The year was considered exceptional for the company, principally in view of the number of active, simultaneous contracts. If, on the one hand this was the main driver of significant revenue growth, on the other it generated pressure on working capital, due mainly to the need to acquire inputs and contract manpower for production.

The challenge in the year was to alleviate this pressure on working capital, which led the company to adopt a strategy of reorganizing processes and renegotiating contracts, focused on reinforcing cash flow without having to cut investments.

Contract renegotiations were aimed at lengthening them, organizing delivery deadlines to ensure that cash flow would enable the acquisition of inputs in a phased manner without hindering the progress of any active projects. This was only made possible by integrating the planning of the processes in course.

At the end of the year, the organization was able to fulfill its expectations, not only establishing a consistent cash flow in line with the needs of the contracts in progress, but also by driving synergy among the different projects being executed simultaneously, better organizing the planning of procurement and payments while honoring financial and tax obligations.

The overseas market continues to be the company's main source of revenue, but we visualize opportunities in the Brazilian market

Influence of the economic conjuncture

The domestic and overseas economic conjunctures exercise a strong influence on Avibras's results and outlook.

Domestically, the federal government's cap on spending resulted in fewer prospects of new contracts, leading company management to expect more timid new order entry.

In the overseas market, the drop in oil prices affected some of our major customers with active contracts, leading to delays in the payment of installments, which in turn increased pressure on cash flow. To resolve this issue the company undertook an active exercise in relationship aimed at finding consensual solutions. This involved adjusting delivery times and payments in order not to compromise the cash flow for each project.

2016 results

NET INCOME

R$ 255

MILLION

NET MARGIN

18%

NET REVENUE

R$ 1.4

BILLION

EBITDA

R$ 425

MILLION

EBITDA MARGIN

31%

Reinforcing cash flow ensures the execution of projects without cutting investments

Outlook

The defense business has cyclical characteristics, alternating between periods when contracts are abundant and less intense moments. With the strategy of lengthening contracts and phasing deliveries, together with the restructuring of processes to drive greater synergy between the projects in progress, Avibras expects to reduce the effects of periods with fewer new contracts, giving the company breathing room to prospect new business opportunities.

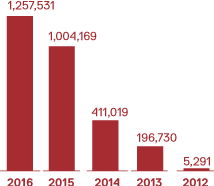

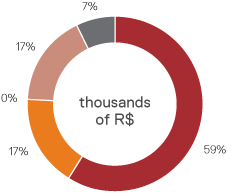

Origin and evolution of gross revenue by product line and market (thousands of R$)

Net revenue by product line (thousands of R$)

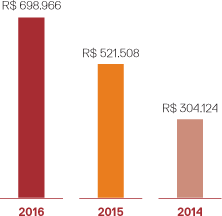

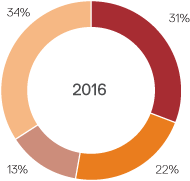

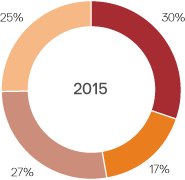

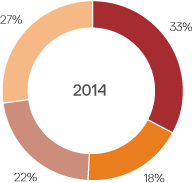

Distribution of added value

Revenue growth from sales, particularly exports, explains the variation in added value in recent years. The new technologies and products developed drive Avibras's competitiveness in the restricted global defense market, promoting a growing backlog of firm contracts, particularly in the export market, boosting operating revenues in the short and long terms and ensuring robust operating results.

Additionally, continuous sales growth means increased taxes and contributions, elevating remuneration for the government and the demand for inputs and services.

During 2015 and 2016, Avibras expanded its work force to fulfill new sales contracts, generating an increase in expenses in the remuneration of labor.

Economic value retained1

1. Direct economic value generated less economic value distributed.

Target

The main target for 2017 is to increase the backlog of contracts which, allied with the modernization of procurement management and the systematic accompaniment of production processes, will boost our EBITDA and profitability indicators.

Added value distributed

Distribution of added value

Generation of Added Value

| 2016 | 2015 | 2014 | |

|---|---|---|---|

| Gross added value¹ | R$ 744,357 | R$ 622,329 | R$ 416,063 |

| Revenues | R$ 1,441,392 | R$ 1,136,009 | R$ 711,822 |

| Inputs acquired from third-parties | R$ 697,035 | R$ 513,680 | R$ 295,759 |

| Net added value produced² | R$ 726,442 | R$ 609,430 | R$ 405,600 |

| Depreciation and amortization | R$ 17,915 | R$ 12,899 | R$ 10,463 |

| Total added value for distribution³ | R$ 742,426 | R$ 614,501 | R$ 407,698 |

| Added value received in transfer | R$ 15,984 | R$ 5,071 | R$ 2,098 |

1. revenues less cost of inputs

2. gross added value less depreciation and amortization

3. net added value + value received in transfer